Chia Tax Statement

This guide will help you understand how to use Spacescan.io's tax reporting features to track and manage your Chia blockchain transactions for tax purposes.

Overview

Spacescan.io provides comprehensive tax reporting tools that help you:

- Track farming income and rewards

- Monitor capital gains/losses

- Generate IRS-compatible tax reports

- Export transaction history in various formats

- Receive automated tax-related notifications

Getting Started

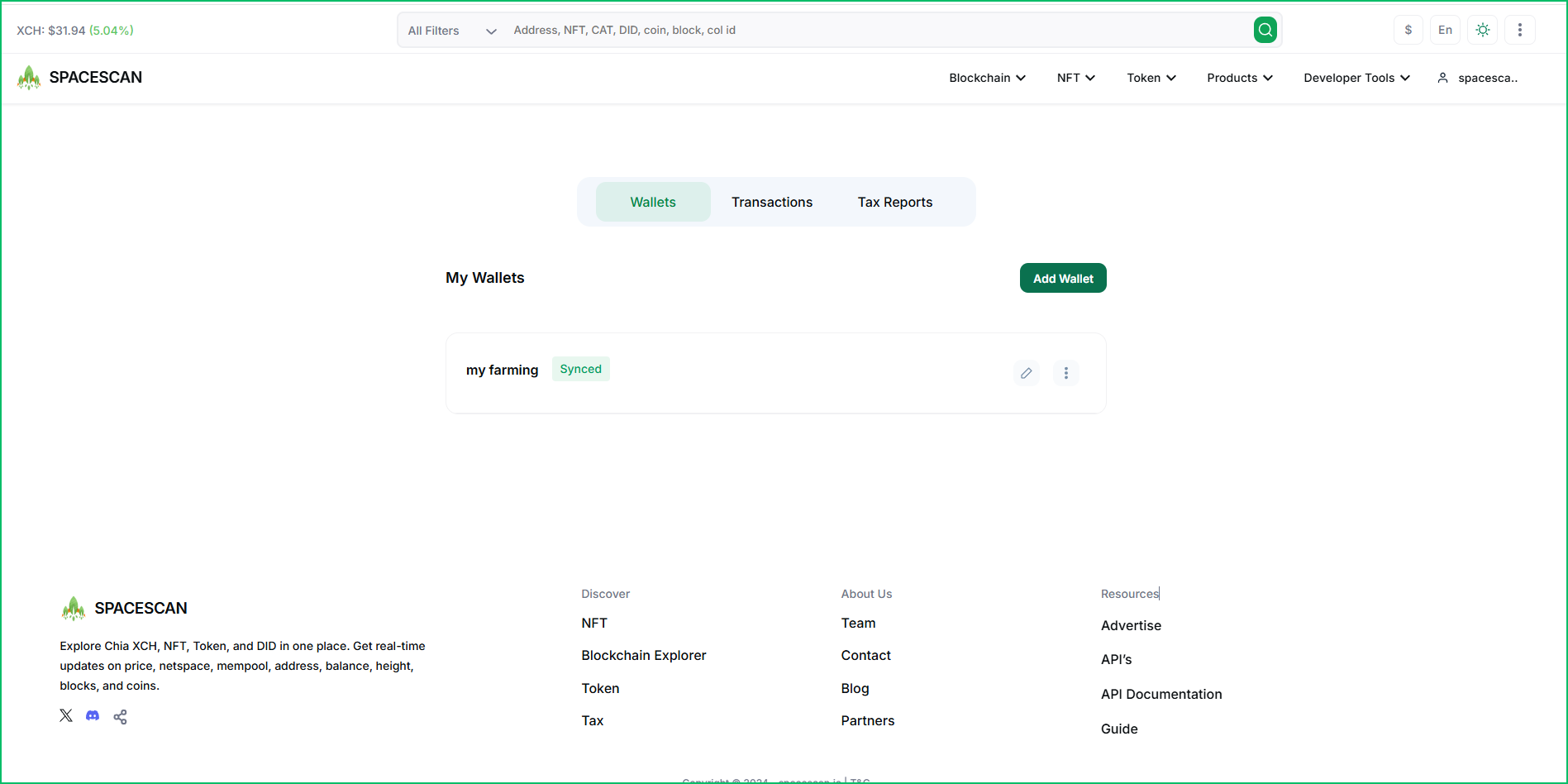

Step 1: Access Tax Reports

Navigate to the Tax Reports section:

- Log into your Spacescan.io account

- Click on "Wallets" in the main navigation

- Select the "Tax Reports" tab

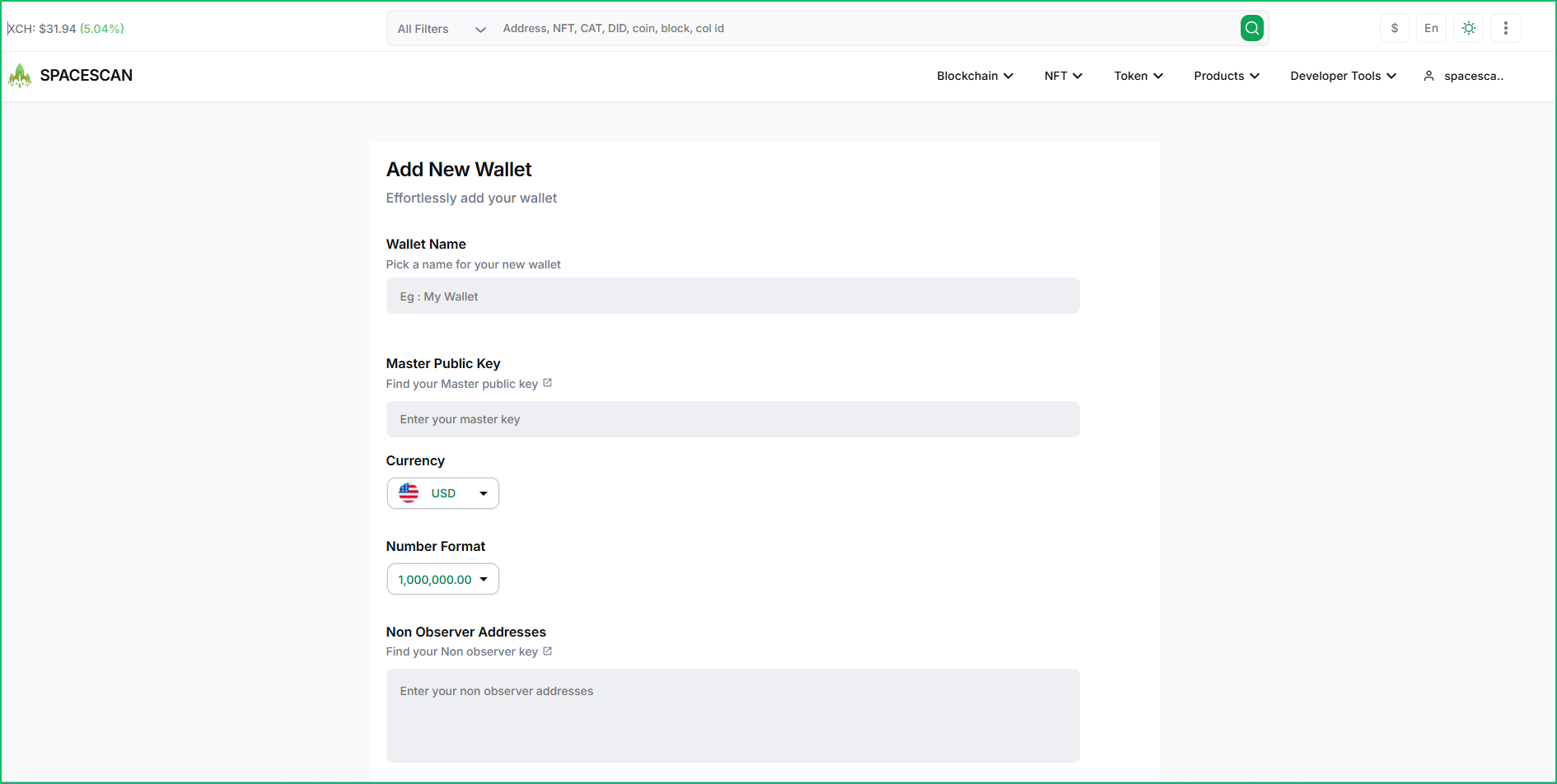

Step 2: Configure Your Wallet

Add your wallet information to begin tracking:

- Click the "Add Wallet" button

- Fill in the required details:

- Wallet Name: Choose a recognizable name

- Master Public Key: Your wallet's public key

- Currency: Select your preferred currency (e.g., USD)

- Number Format: Choose your preferred format

- Non Observer Addresses (optional)

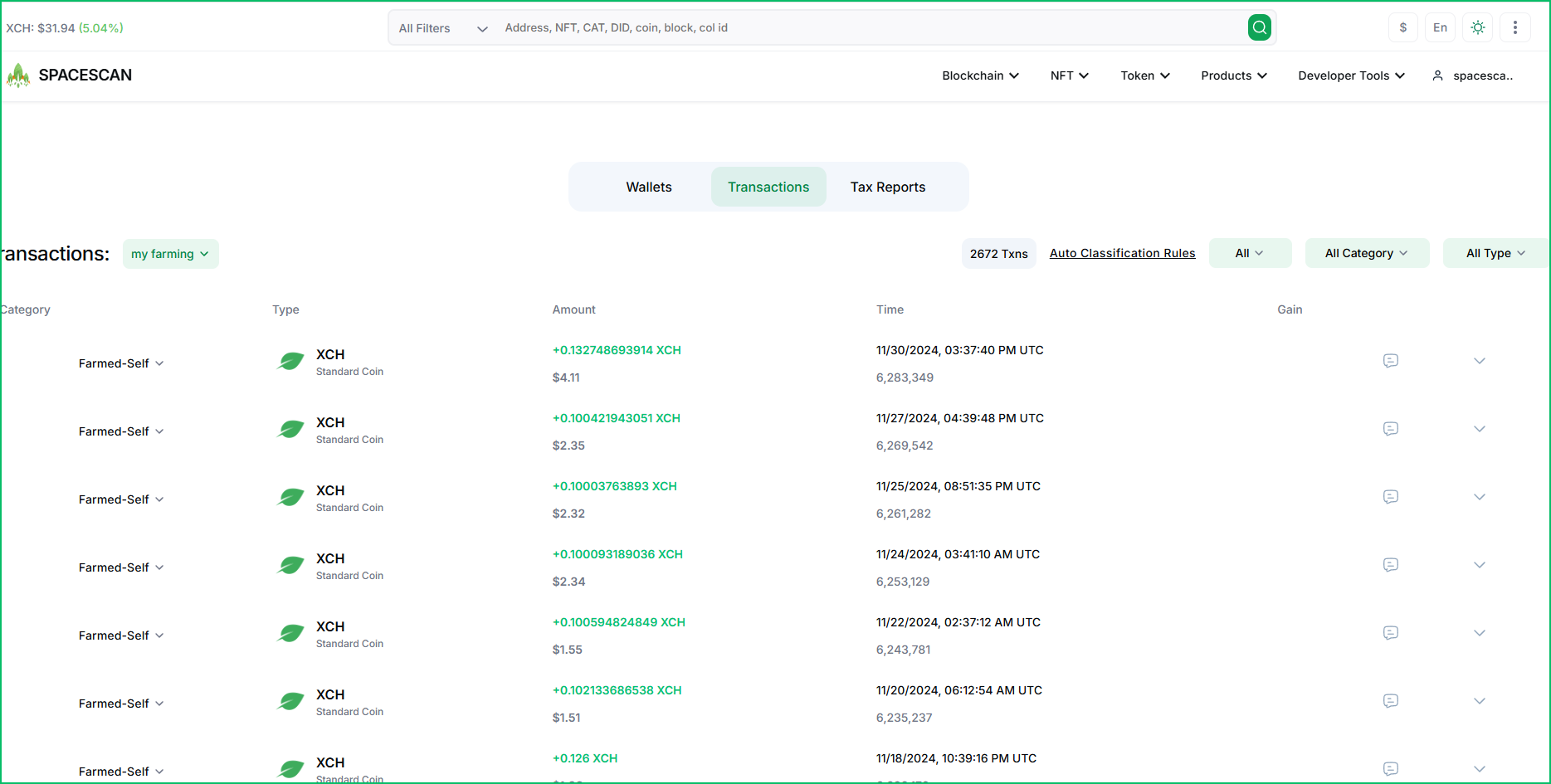

Transaction Monitoring

Viewing Transaction History

Monitor all your transactions in one place:

- Select your wallet from the dropdown menu

- View detailed transaction information:

- Transaction type and category

- Amount and timestamp

- Gain/Loss calculations

- Transaction status

Understanding Transaction Categories

Transactions are categorized as:

- Farming Income: Rewards from farming

- Pooling Income: Rewards from pool farming

- Trading: Buy/sell transactions

- Transfers: Wallet-to-wallet movements

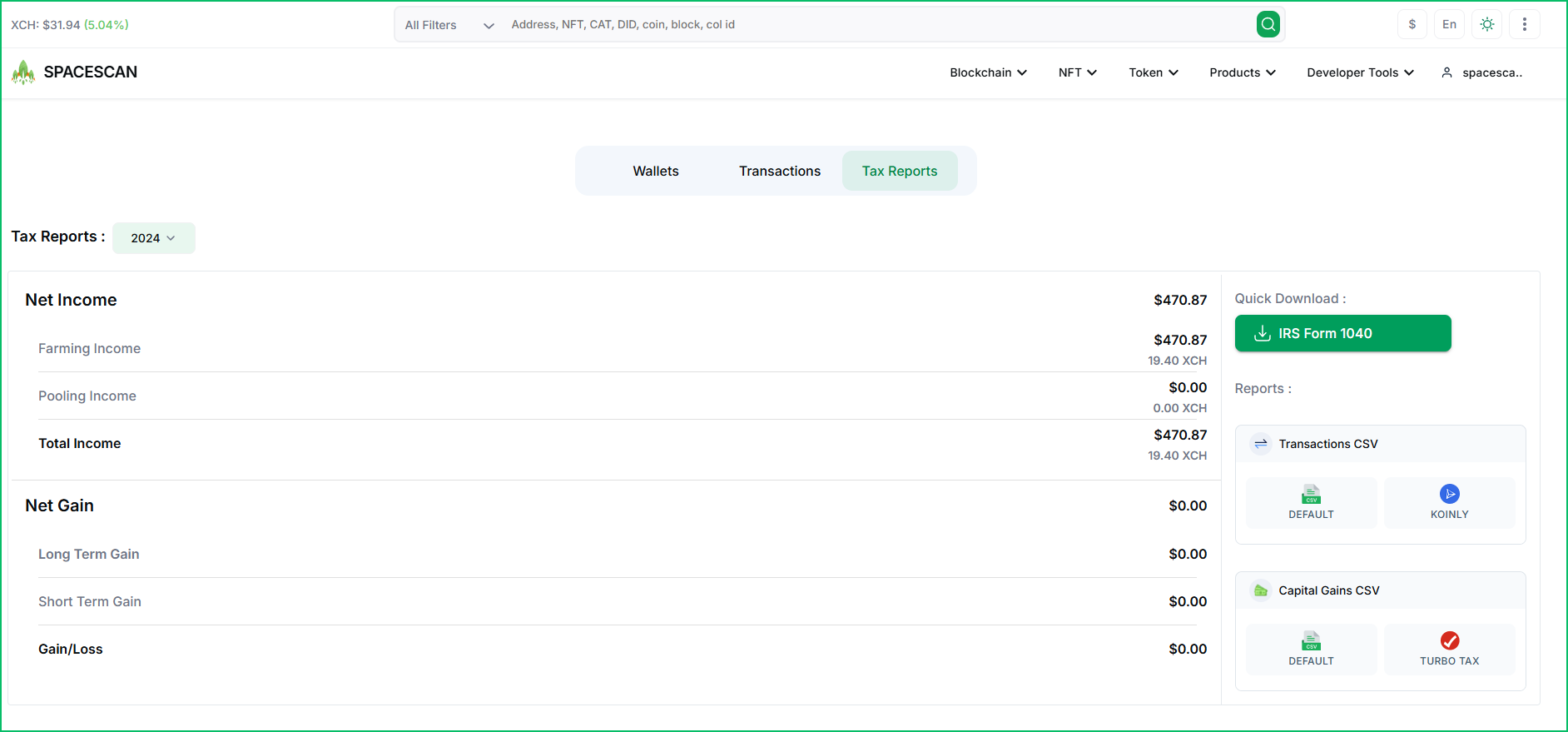

Tax Report Generation

Available Reports

The platform offers several types of tax reports:

-

Net Income Reports

- Farming income summary

- Pooling income details

- Total income calculations

-

Capital Gains Reports

- Long-term gains/losses

- Short-term gains/losses

- Aggregate gain/loss summary

Downloading Reports

Export your tax information in multiple formats:

-

IRS Form 1040

- Quick download for official filing

- Pre-formatted for tax submission

-

Transaction Reports

- DEFAULT format for general use

- KOINLY compatible format for tax software

-

Capital Gains Reports

- DEFAULT format with detailed calculations

- TURBO TAX compatible format

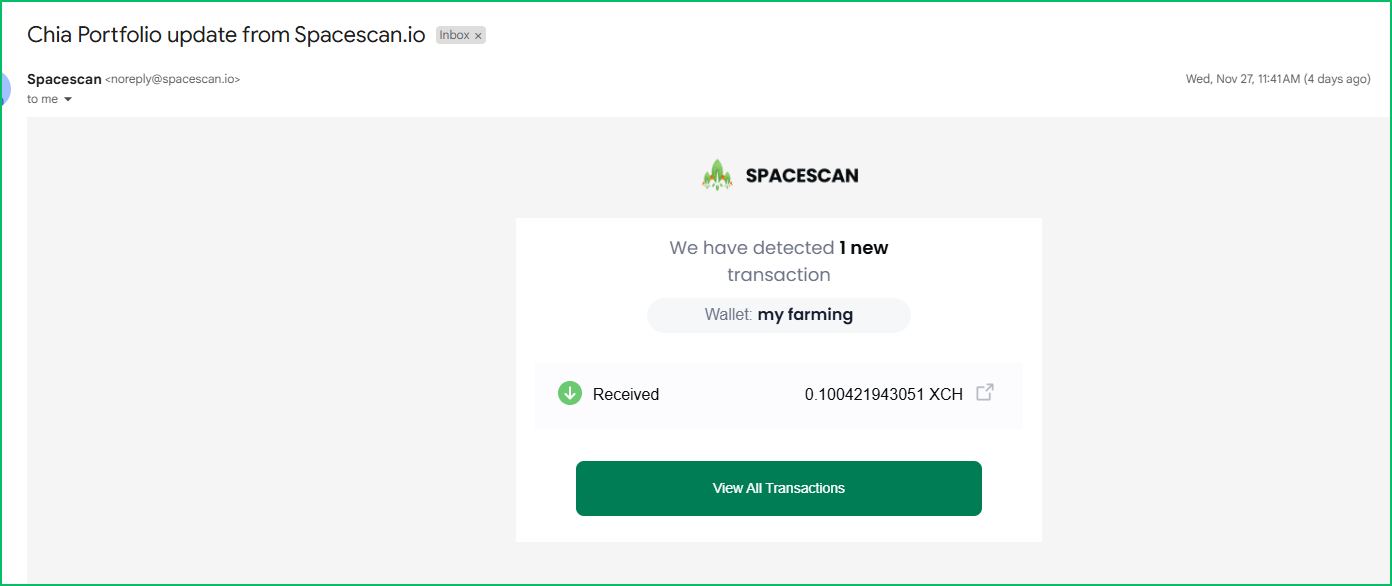

Automated Notifications

Stay updated with automated email notifications:

- Transaction alerts

- Report generation confirmations

- Tax deadline reminders

- Important updates and changes

Best Practices

-

Regular Updates

- Keep your wallet information current

- Monitor transactions frequently

- Download reports periodically

-

Record Keeping

- Store downloaded reports securely

- Maintain backup copies

- Document any manual adjustments

-

Compliance

- Verify tax calculations

- Consult with tax professionals

- Stay informed about regulations

Tips and Recommendations

Check your tax reports monthly to ensure accurate tracking and avoid end-of-year surprises.

While our tools provide comprehensive reporting, we recommend consulting with a tax professional for specific advice about your situation.

Tax regulations vary by jurisdiction. Ensure you understand your local tax requirements and maintain appropriate records.

Support and Resources

If you need assistance with tax reporting:

- Check our FAQ section

- Contact our support team

- Review our tax documentation

- Consult the Chia Network tax guidelines

Next Steps

After setting up tax reporting:

- Configure automated notifications

- Schedule regular report downloads

- Set up backup procedures

- Review transaction categorization

For additional help or feature requests, please contact our support team.